At Woori Bank, employees had to endure multiple login steps every morning from the moment they arrived at work.

A Workday That Couldn’t Even Begin Because of Logins

To start the day, employees first had to log in to their Windows PCs with an ID and password. After that came more logins—for email, work portals, groupware, and HR or finance systems. Each system had different ID and password rules, and with frequent mandatory password changes, remembering them all became a daily struggle. Employees often spent an excessive amount of time just logging in. Across the entire bank, nearly 20,000 staff were losing valuable time every single day.

The Bank’s Solution: AutoPassword

To tackle this issue at its root, Woori Bank actively explored passwordless technologies. The final choice was AutoPassword—a passwordless solution based on the international standard ITU-T X.1280. Instead of entering passwords themselves, employees approve automatically generated one-time passwords through their smartphones. In other words, there’s no longer any need to remember or type passwords at all.

No Costly Biometric Hardware—Just Smartphones

One of the biggest reasons Woori Bank chose AutoPassword was its cost efficiency and universality. Conventional biometric-based solutions would have required installing fingerprint or iris scanners on every employee’s PC—an enormous expense for an organization operating tens of thousands of devices. AutoPassword, on the other hand, simply leverages the biometric sensors already built into employees’ smartphones. This eliminates the need for new hardware purchases while keeping management simple and efficient. And because AutoPassword is built on international standards, the bank also secured long-term stability and scalability.

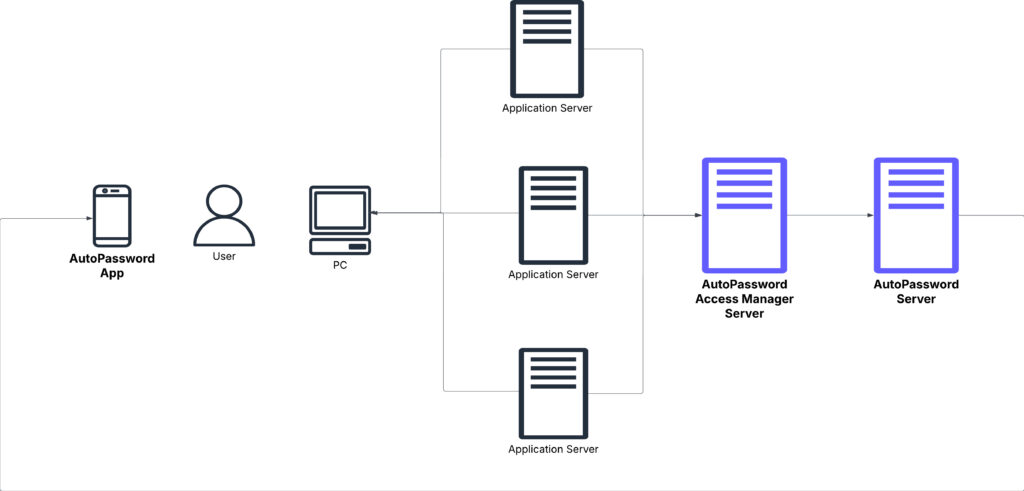

Strengthening SSO Security with AutoPassword

Woori Bank had already been using a Single Sign-On (SSO) system internally. While SSO offers the convenience of accessing multiple systems with a single login, it also comes with a critical risk: if an account is compromised, every connected system is exposed. To address this, Woori Bank integrated AutoPassword with its existing SSO system.

The result was a double layer of security without sacrificing convenience. Employees still enjoy the simplicity of logging in once to access all systems, but now the password has been completely eliminated and replaced with a secure mutual authentication process.

Security and Efficiency, Achieved Together

The bank’s move to passwordless authentication was about more than simplifying logins. For employees, it meant freedom from the burden of password management and the stress of daily logins—allowing them to focus fully on their work. From a security perspective, AutoPassword eliminates traditional attack vectors such as phishing, pharming, and man-in-the-middle attacks. From a cost perspective, the smartphone-based solution removed the need for additional hardware investments, ensuring strong economic value.

As a result, Woori Bank became the first financial institution in Korea to eliminate passwords across all systems used by its 20,000 employees—a true industry milestone.

Conclusion

In today’s era of accelerating digital transformation, security and convenience are no longer a trade-off. Woori Bank’s success story demonstrates that eliminating passwords is not just about ease of use—it is a genuine innovation that strengthens security and boosts operational efficiency at the same time.